Austen Frakt has a post today describing the effect of an employer mandate in San Francisco. This got me thinking about the theoretical reason for mandates, and led to this article in JEP by Liran Einav and Amy Finkelstein graphically representing adverse selection and more interestingly advantageous selection, which I had never heard of.

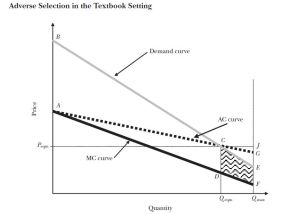

This graph comes from their article and demonstrates textbook adverse selection:

The graph shows the Demand curve, which indicates the individuals willingness to pay for an insurance contract. All individuals are homogeneous in risk aversion, and for these individuals, their willingness to pay is equal to their expected cost (riskiness) plus their risk premium. This means that people who are willing to pay the most are also going to cost the most, and this is represented with the downward sloping marginal cost curve- this is adverse selection. The risk premium is given by the distance between the MC curve and the Demand curve, and since all individuals are assumed to be risk averse the willingness to pay is always greater than the MC so it is efficient for all individuals to have insurance. Unfortunately, the equilibrium condition in this market is when Average cost hits the Demand Curve, which is less than the efficient amount of insurance. This provides the theoretical justification for mandates.

The picture above assumes there are no frictions or additional costs of insurance which is obviously not realistic. The authors demonstrate graphically that including these costs can lead to results that do not support the use of mandates. The authors also graphically demonstrate the insurance death spiral if you’re interested, but I want to focus on advantageous selection.

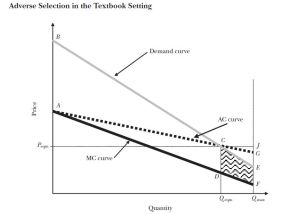

This graph comes from the same article:

The authors state that insurance markets without administrative costs (“loading costs” in the article) don’t have any inefficiency. This graph assumes that there are other costs of insurance, and in this case the people who are less risky (lower expected cost) are also more risk averse (higher willingness to pay), and this is demonstrated in the upward sloping MC curve. This is plausible- people who value car insurance more highly are probably more likely to drive safely. In other words In this situation, the equilibrium quantity, where AC hits the Demand Curve, is more than the efficient quantity of insurance sold (Demand= MC) so there is welfare loss in too much insurance. Clearly, in this market there is no theoretical justification for mandates.

The authors state that insurance markets without administrative costs (“loading costs” in the article) don’t have any inefficiency. This graph assumes that there are other costs of insurance, and in this case the people who are less risky (lower expected cost) are also more risk averse (higher willingness to pay), and this is demonstrated in the upward sloping MC curve. This is plausible- people who value car insurance more highly are probably more likely to drive safely. In other words In this situation, the equilibrium quantity, where AC hits the Demand Curve, is more than the efficient quantity of insurance sold (Demand= MC) so there is welfare loss in too much insurance. Clearly, in this market there is no theoretical justification for mandates.

The authors state that some markets are characterized by adverse and some by advantageous selection but they do not review the empirical evidence. My guess would be that health insurance markets are more adverse selection, but I do not have anything empirical to support that conjecture. The authors of the article then go on to outline empirical strategies for determining what type of selection is present in insurance markets. The whole article is interesting and should be read.